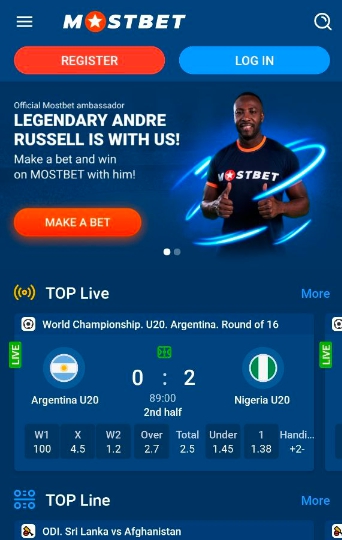

Mostbet India is a popular bookmaker among Indian bettors. It has been offering a wide range of sports betting and online casino games since 2009. The company operates legally (under license from Curacao). Its users can play both on the official website or through a mobile application.

How to sign up in Mostbet

You can register both on the Mostbet com website and in the bookmaker’s mobile application.

Follow these steps to register:

- Get on the official website or app of the bookmaker.

- Click the “Register” button at the top of the screen.

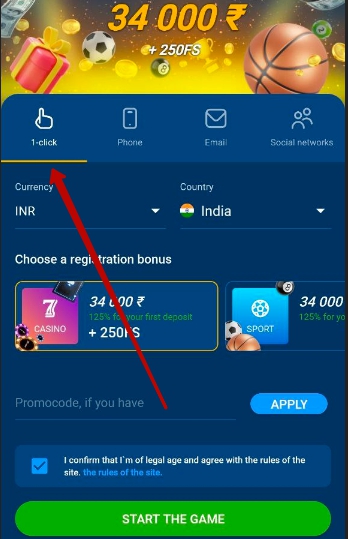

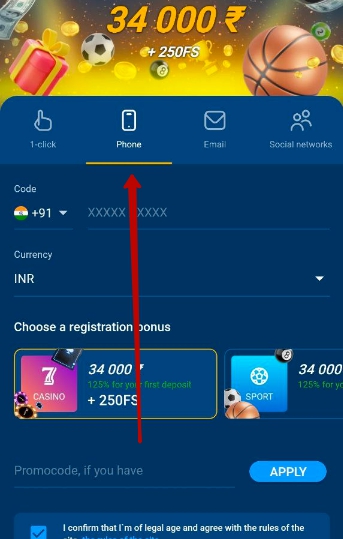

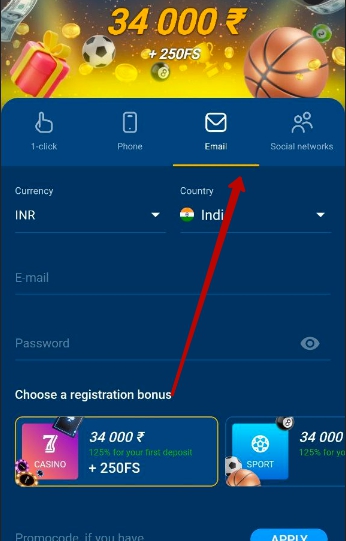

- Select the registration method (currently 4 options are available: in 1 click, by phone, via e-mail, via social networks).

- Fill in the registration fields, select a bonus, enter a promotional code (if available).

- Agree with the rules of the site.

- Click “Start The Game”.

Despite the fact that different methods of registration involve similar actions, there are still small discrepancies. Let us consider them in more detail.

Registration in 1 click:

- Select a country.

- Choose a currency.

- Go for the certain bonus type (for sports betting or online casino).

- Enter a promo code (if available).

- Agree with the rules of the site.

- Click “Start The Game”.

Registration by phone:

- Enter a phone number.

- Select a currency.

- Select the bonus type.

- Enter a promotional code (if any).

- Agree with the rules of the site.

- Click “Start The Game”.

Registration by e-mail:

- Select a country.

- Opt for a currency.

- Enter your e-mail.

- Enter the password.

- Select the bonus type.

- Enter a promo code (if available).

- Agree with the rules of the site.

- Click “Start The Game”.

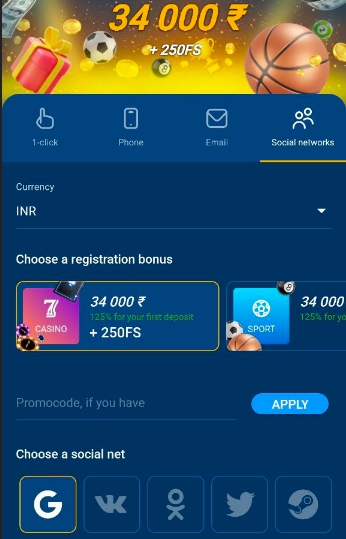

Registration via social networks:

- Select a country.

- Choose the preferred bonus type.

- Provide a promo code (if any).

- Select a social network: Google, Vkontakte, Odnoklassniki, Twitter or Steam.

- Agree with the rules of the site.

- Click “Start The Game”.

Registration in this way involves authorization in the selected social network. After that, a game account with Mostbet will be created automatically.

Mostbet account verification

Verification on the Mostbet IN website is a mandatory procedure. The bookmaker points out that clients’ financial security is its main priority. Thus, by filling in personal data in the account, the client confirms their identity and ensures safety of their funds. Without verification, the bookmaker and online casino users cannot withdraw money from the gaming account.

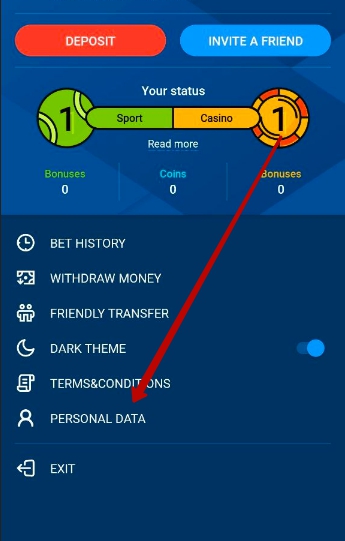

Here are the instructions for the account verification procedure:

- Open the main menu.

- Select “Profile and withdrawal”.

- Click “Personal Data”.

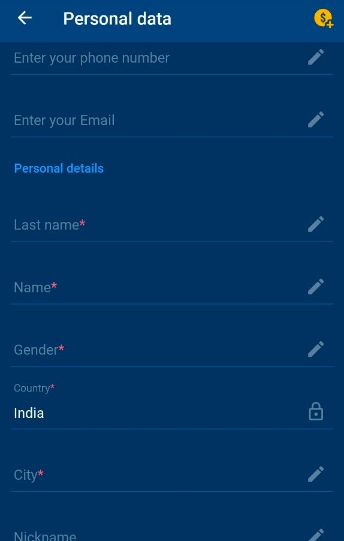

- Fill in information about yourself (at least complete the fields marked with an asterisk).

In your personal profile, add the following information:

- Last name;

- Name;

- Gender;

- Country;

- City;

- Date of birth;

- Document Number.

You also have to send a photo of the document and a selfie with the document to the company’s support service. It is important that the information in the photo exactly matches the information indicated in the personal profile.

It is not obligatory to provide the passport data. You can use other documents, such as personal insurance policy number, military ID, sailor’s passport, foreign passport, driver’s license, and NID Number.

How to deposit

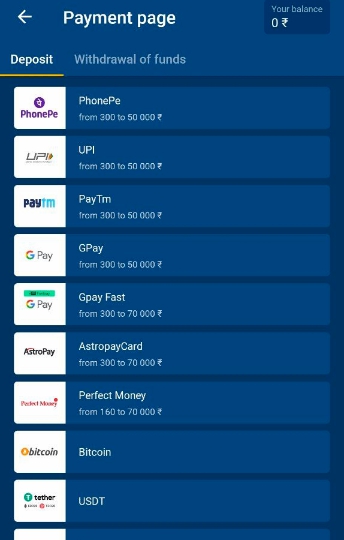

In the personal account of www mostbet com, three dozen ways to replenish an account for users from India are available.

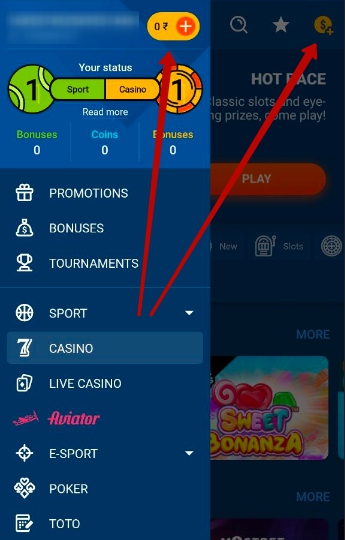

To replenish your game account balance, log in to the site and click the “$” button at the top of the screen (or open the menu and click “+”).

At the moment, you can make a deposit in BC Mostbet via the following payment systems:

- UPI;

- PhonePe;

- PayTM;

- AstropayCard;

- Perfect Money;

- Gpay;

- Gpay Fast;

- Bitcoin;

- USDT;

- ETH;

- Ripple;

- LTC;

- Bitcoin Cash;

- BNB;

- DOGE;

- DASH;

- Zcash;

- CSC;

- BTCB;

- ADA;

- DESU;

- HT;

- TRX;

- USDC;

- AXS;

- DAI;

- BUSD.

Withdrawal methods

To withdraw funds from the game account, open the same section as when replenishing the account, but select the “Withdrawal of funds” tab.

Mostbet offers the following funds withdrawal methods to users from India:

- PayTM;

- UPI;

- Neteller;

- Bitcoin;

- Litecoin;

- Ethereum;

- Ripple;

- Bank Transfer.

Mostbet bonuses

Mostbet bonus is an amazing option to get additional benefits while playing. Namely, some extra funds can be added to your deposit, as well as FreeBets, FreeSpins, CashBack and other pleasant gifts can be awarded.

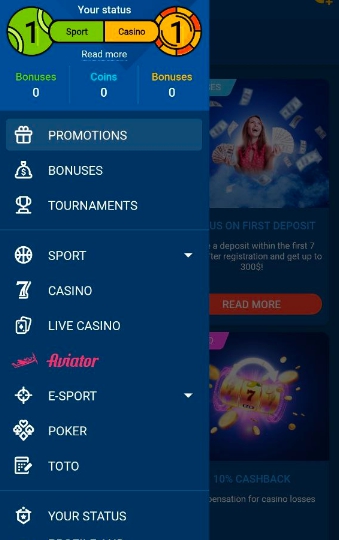

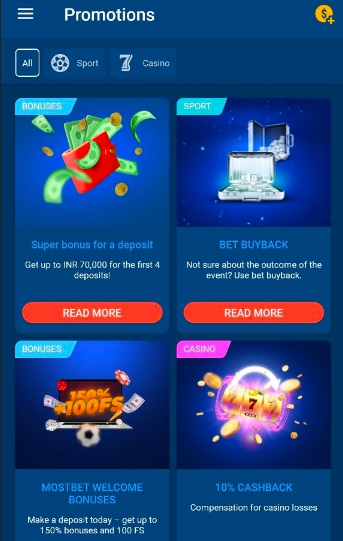

All current Mostbet bonuses are described in the Promotions section of the main menu.

At the time of this writing, the section contains 12 different bonus and promotional offers. Now, we will take a look at the most popular of them:

- Bonus on first deposit;

- 10% CashBack;

- Triumphant Friday;

- Risk-free Promo;

- Bet insurance;

- Birthday with Mostbet;

- Invite Friends.

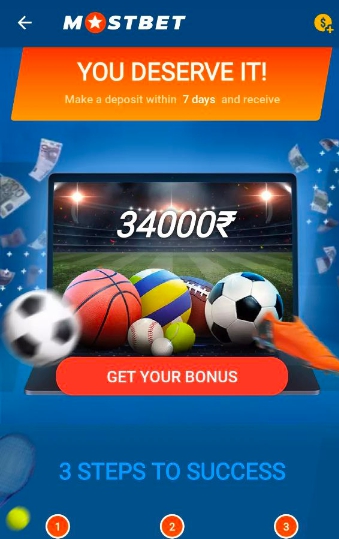

The “Bonus on first deposit” is the most beloved with users. It enables newly-registered clients to get up to +125% to the first deposit (up to 34000 INR), as well as 250FS for online casino.

The conditions for receiving the bonus are very simple:

- Top up your account.

- Get bonuses on your bonus account.

- Fulfill the wagering requirements to transfer funds to the main account.

The standard bonus amount is +100% of the deposit. For example, if you replenish your account with 100 INR, the bonus amount will be the same – 100 INR.

To receive an increased bonus, replenish your account with one payment in the amount of 300 INR. In this case, the bonus amount will be +125% of the deposit. For instance, if you deposit 500 INR, you will receive 625 INR to your bonus account. To get additional 250FS for online casino games, the deposit amount must be at least 1000 INR.

To wager the bonus, wager the bonus amount 5 times on express bets. The express bet must consist of at least 3 events with the odds 1.40 or above. The bonus has to be wagered within 30 days from the date of its accrual.

Bet types and odds

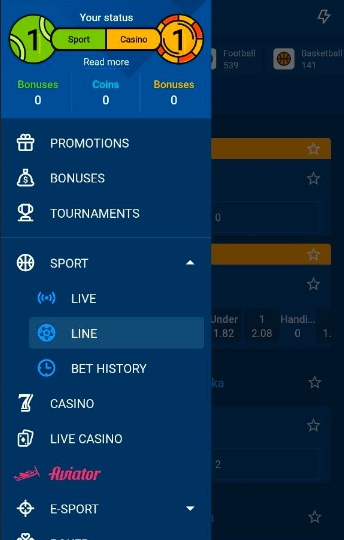

The betting section in the main menu is represented by two bet categories: Live and Line. You can also view the betting history in the identically named section – “Bet History”

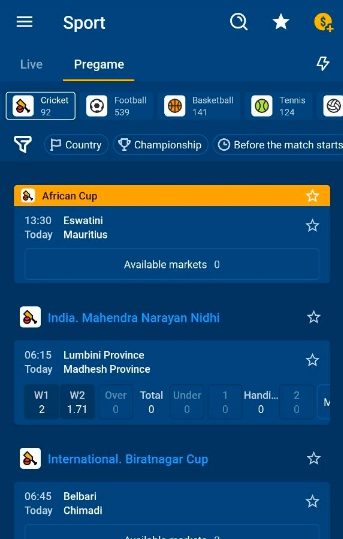

Three dozen sports disciplines are presented in the “Line” section. In addition to cricket, football, badminton, tennis, volleyball, basketball and hockey, this section also features niche sports such as:

- Lacrosse;

- Squash;

- Gaelic Football;

- Floorball;

- Chess;

- Billiard and others.

The choice of events in each discipline is also quite extensive. For example, at the time of writing, the Football section has 539 matches, the Cricket section has 92 matches, and the Badminton section has 76 matches.

In the “Live” mode, on a typical weekday, you can see from 10 to 15 sports, which is also quite impressive. In addition to cricket and football in real time, you can usually bet on badminton, table tennis, tennis, basketball, volleyball.

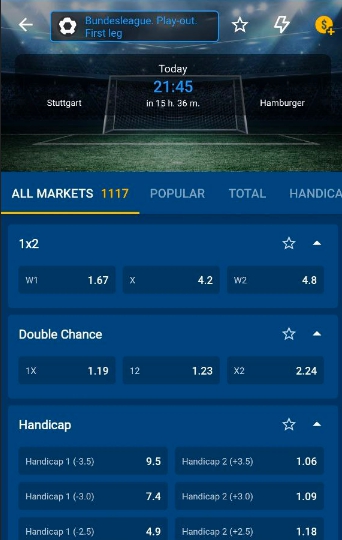

Mostbet line has excellent betting market options. For example, 1117 markets are available for the transition match of the German Football Championship for the right to play in the Bundesliga between the teams “Stuttgart” and “Hamburger”. You can see up to 2000 options for the finals or interesting matches of the European Cup playoffs. However, it should be mentioned that the number of markets is growing as the start time of the event approaches.

In addition to the main markets for victory, odds and totals, there is also an opportunity to bet on various statistical indicators: off-sides, throw-ins, fouls, corners, and so on.

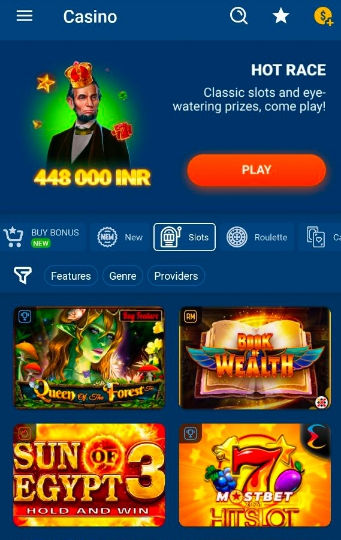

Casino Mostbet India

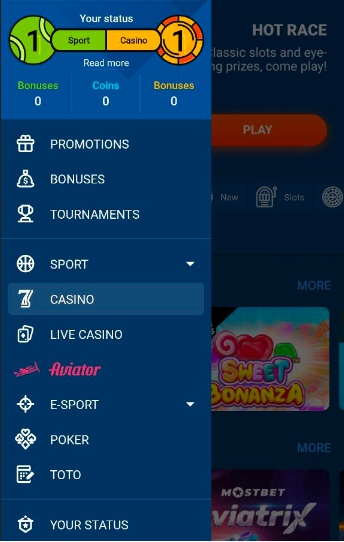

To end up in the Mostbet casino section, open the main menu and select the “Casino” or press “Live Casino” tab.

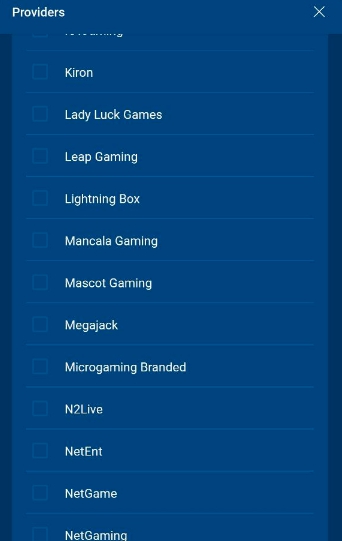

Here the games from well-known and reliable world providers are on offer: Playson, SmartSoft, EvoPlay, BGaming, Amatic, Betsoft, Evolution Gaming, Igrosoft, NetEnt and others.

Among the available games in the “Casino” section, the following categories are provided:

- Slots;

- Roulette;

- Cards;

- Lottery;

- JackPots;

- Fast Games;

- Virtuals.

Slots are traditionally the most often played casino games by Indian casino customers. Slot machines can be sorted by new, popular, and by features (for example, the presence of a jackpot or the risk level of a game), genre (for example, animals or adventures), and providers.

The most popular slots in Mostbet are:

- Aviator;

- Wild Bandito;

- Sun of Egypt 3;

- 777 Burning Wins;

- Sweet Bonanza;

- Magic Apple;

- 9 Coins;

- Lucky 3 and others.

In 2022, 2023 and 2024, Aviator is the most requested game among Indian gamblers. This is a modern high return to player (RTP) slot that does not resemble any classic reel and line slots.

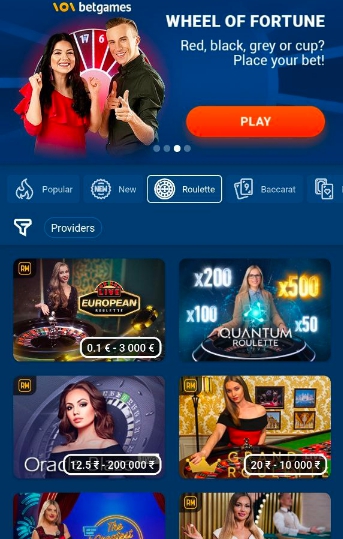

The “Live Casino” section presents games with live dealers, which gives players the opportunity to fully immerse in the atmosphere of a real casino.

The games below are also on the list of popular entertainment in Live Casino:

- Roulette;

- Baccarat;

- BlackJack;

- Poker;

- TV Games;

- VIP.

Mostbet mobile application

Mostbet App is a mobile program for fast and convenient gaming from a smartphone or tablet.

To download the mobile app, follow these steps:

- Open the official website of the Mostbet company.

- Tap the Android or iOS icon (depending on the operating system of your mobile device).

- Click “Download for Android” or “Download on The App Store”.

- Confirm the file download.

- Wait for the installation file to download to your device.

The download process will take up to 10 seconds. Approximately the same amount of time is required for further installation of the mobile program. To install the app, open the downloaded file and click “Install”. After installation, the Mostbet icon will appear on the desktop of a smartphone or tablet.

Advantages of the Mostbet mobile application are as follows:

- There is no need to enter your login and password every time you sign in. You can do with specifying the authorization data just once. Your subsequent logging in will be performed automatically;

- The mobile app works faster than the browser-based mobile version. The fact is that many elements are immediately downloaded to the mobile device. On the other hand, in the mobile version, each page is loaded separately, which takes time. This advantage is especially beneficial for players who bet in the “Live” mode, where the odds are constantly changing;

- The mobile application works even at a weak Internet signal;

- Access to the mobile application is available 24/7, even if the official website is down. In addition, the program cannot be blocked by providers. Therefore, you do not have to constantly look for a working Mostbet mirror;

- All functions of the mobile version are available in the mobile application. You can replenish your account and withdraw funds using available payment systems, play in a bookmaker’s office and online casino, use promotional and bonus offers, and contact the support service.

Customer service

There are several ways to contact a mostbet com technical support representative. You can choose from the options provided in the “Support” section of the main menu:

- Online chat;

- E-mail: [email protected];

- Telegram.

The fastest way to get a response from a consultant is to use the online chat. In this case, the operator will respond in 1-2 minutes.

FAQ

Is it safe to play in Mostbet India? Does the sportsbook have a license?

Yes, Mostbet operates legally in India under the international license of Curacao. It is completely safe to play at the bookmaker and online casino Mostbet.

Can I replenish my account with Indian Rupees?

Yes. When registering an account, select the account currency INR. In this case, payment systems compatible with Rupees will be available for financial transactions.

What are the quick withdrawal methods?

The company offers many ways to withdraw funds from the game account balance. The most popular methods include Paytm, UPI, Neteller, Bitcoin. Litecoin, Ethereum, Ripple, Bank Transfer. However, please note that in order to withdraw funds, you must first go through the account verification procedure.